Payment channels are a unique solution to the scalability problems decentralized blockchains face; they allow for faster and more efficient transactions.

What are Payment Channels?

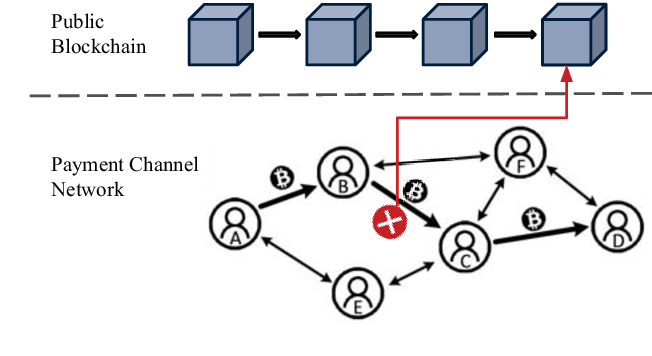

Payment channels are a type of off-chain solution for blockchain systems. They allow for the creation of a private payment channel between two parties, which can be used to conduct a series of transactions off the main blockchain. Payment channels are created by locking funds in a smart contract, which is then used to conduct the transactions.

Payment channels are different from on-chain transactions, which are recorded directly on the blockchain. With payment channels, the transactions are recorded off the blockchain, and the final state of the transactions is recorded on the blockchain only when the channel is closed. This allows for faster and more efficient transactions, as they do not need to be validated by the entire blockchain network.

How do Payment Channels work?

Payment channels work by creating a smart contract on the blockchain that holds the funds of the two parties involved in the transaction. The transactions inside the channel are signed by both parties and can be conducted instantly, without needing to wait for a transaction to be validated on the main blockchain.

The smart contract is designed in such a way that the final state of the transactions can be recorded on the main blockchain at any time. This is done by closing the payment channel, which triggers the final settlement of the transactions on the blockchain. This final settlement is done by broadcasting the last transaction to the blockchain, which records the final state of the payment channel.

Keeping Things Secure Off-Chain

Payment channels utilize the security of the blockchain while conducting transactions off-chain. This is done through use of a "challenge period" in which the settlement is not finalized, to account for the case that both parties do not agree on the final state of the channel. Funds are locked for an additional amount of time to allow for a counterparty in the channel to submit a dispute transaction, showing a newer agreed transaction.

Some payment channel designs impose penalties on a channel participant for closing the channel with an older transaction.

What are the advantages of Payment Channels?

Payment channels offer several advantages over traditional on-chain transactions. Some of these advantages include:

- Faster and more efficient transactions: Payment channels allow for instant transactions, without needing to wait for the transaction to be validated on the main blockchain. This makes transactions faster and more efficient, especially for micropayments.

- Lower fees: Since payment channels are conducted off the main blockchain, the fees for each transaction are significantly lower. This makes payment channels more cost-effective, especially for small transactions.

- More private transactions: Payment channels are designed to be private, as the transactions are conducted off the main blockchain. This makes payment channels more secure and less vulnerable to attacks, such as double-spending.

- Scalability: Payment channels allow for a higher throughput of transactions, as they do not need to be validated by the entire blockchain network. This makes payment channels a scalable solution for blockchain systems.

Conclusion

Payment channels are a promising solution to the scalability issues of blockchain systems. They offer faster and more efficient transactions, lower fees, more private transactions, and scalability. While rollups have garnered significant interest as the path for scaling blockchains, payment channels offer an unmatched answer to the challenge of the blockchain trilemma and are likely to become an increasingly important part of the blockchain ecosystem. Bitcoin's Lightning Network is the best example of payment channels in use today.